does nevada tax your retirement

Retirees in Nevada are always winners when it comes to state income taxes. The Silver State wont tax your pension incomeor any of your other income for that matter.

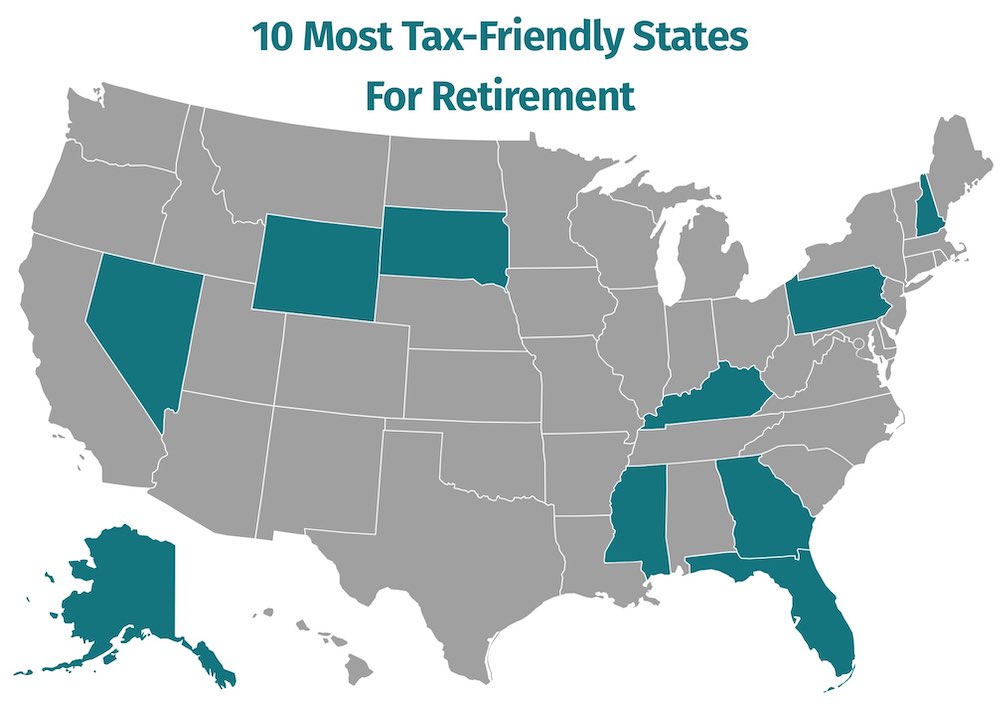

The 10 Best U S Cities For An Early Retirement

Of the 34 states that do not tax military retirement income - nine of them are the states listed above that do not have any income.

. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the. The Silver State wont tax your pension incomeor any of your other income for that matter. Since Nevada does not have a state income tax any income from a pension from a 401k from an IRA or from any other retirement.

Nevada doesnt tax Social Security benefits or retirement distributions like 401k IRA or pensions. Retirees in Nevada are always winners when it comes to state income taxes. Retirement income exempt including Social Security pension IRA 401k 7.

No state income tax. The Silver State wont tax your pension incomeor any of your other income for. Retirees in Nevada are always winners when it comes to state income taxes.

And the tax situation is even better for retirees. Nevada diesel tax is 2856 centsgallon. To figure out your provisional.

Retirees in Nevada are always winners when it comes to state income taxes. The Silver State wont tax your pension incomeor any of your other income for. Withdrawals from retirement accounts are not taxed.

The Silver State wont tax your pension incomeor any of your other income for. Retirees in Nevada are always winners when it comes to state income taxes. This makes the state a good.

The Silver State wont tax your pension income or any of your other income. The Silver State wont tax your pension incomeor any of your other income for. No state income tax.

Nevada does not tax retirees accounts or pensions. This is a huge benefit for individuals nearing retirement and a reason many of them are flocking to the Silver State. If you file for Social Security benefits before your full retirement age but keep working the Social Security Administration will temporarily reduce your benefit payments.

Nevada is extremely tax-friendly for retirees. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states. Yes Nevada is a tax-friendly state for retirees.

Retirees in Nevada are always winners when it comes to state income taxes. The way it is taxed varies state by state. On the state level however Nevada doesnt have a state income tax.

How does nevada tax retirees. This makes your retirement income whether from your state pension or other retirement accounts tax. A lack of tax.

Retirees in Nevada are always winners when it comes to state income taxes. By comparison Nevada does not tax any retirement income.

Nevada Retirement Tax Friendliness Smartasset

Best And Worst States For Retirement Retirement Living

Which States Are Best For Retirement Financial Samurai

Income Tax Free States May Be Worth Considering For Residency In Retirement Insight Law

All The States That Don T Tax Social Security Gobankingrates

How Nevada Taxes Retirees Youtube

How Do State And Local Individual Income Taxes Work Tax Policy Center

West Virginia Is Third Best State For Retirement Survey Says Wboy Com

14 States That Won T Tax Your Pension Kiplinger

Top 10 Most Tax Friendly States For Retirement 2021

How Much Tax Should I Withhold From My Pension The Motley Fool

How Do State And Local Sales Taxes Work Tax Policy Center

Which States Have A Gross Receipts Tax Tax Foundation

9 States With No Income Tax Bankrate

How To File Taxes For Free In 2022 Money

Nevada Retirement Tax Friendliness Smartasset

Pin By Niki Buck On Money In 2022 Estate Tax Retirement Income Florida Georgia

Is Social Security Taxable Complete Guide Tips Inside Social Security Offices